KARACHI: After breaking a four-session losing streak overnight, the stock market on Wednesday struggled as investor sentiment remained mixed due to a lack of positive triggers, forcing the benchmark KSE 100 index into the red zone on late profit selling.

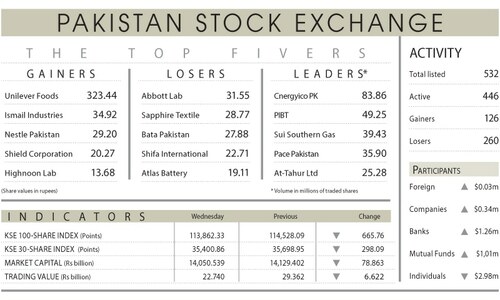

Topline Securities Ltd said the stock market had a range-bound session, with the benchmark index moving between a high of 583 points and a low of 598 points. It ultimately closed at 112,254 points, marking a decline of 490 points or 0.43 per cent day-on-day.

The upward movement was mainly driven by Engro Holdings, Tariq Glass Industries Ltd, Lucky Cement, Pakistan International Bulk Terminal (PIBTL), and Nestle Pakistan, contributing 155 points to the index together. Conversely, Engro Fertiliser, Fauji Fertiliser, and PSO took away 181 points.

Ahsan Mehanti of Arif Habib Corporation noted that the market fell sharply lower in sympathy with a sell-off in Asian markets and a slump in global crude oil prices after the Trump administration imposed tariffs on Canada, Mexico and China, triggering a tariff war.

Ali Najib, Head of Sales at Insight Securities, said the finance minister’s comment that Pakistan was “well positioned” for the ongoing IMF review boosted investor confidence, leading to buying in initial trading hours. However, above the 113,000 level, some investors opted to book profits, wiping out early gains.

The overall market activity remained bearishly inclined, although trading volume rose 27.61pc to 263.96 million shares while the traded value increased 21.11pc to Rs13.73bn day-on-day.

Stocks contributing significantly to the traded volume included Pakistan International Bulk Terminal (53.57m shares), WorldCall Telecom (23.56m shares), Power Cement (10.97m shares), Fauji Cement (8.50m shares) and Maple Leaf Cement (8.04m shares).

The shares registering the most significant increases in their share prices in absolute terms were Nestle Pakistan (Rs149.20), Sapphire Textile (Rs88.40), Sapphire Fibres (Rs35.49), Reliance Cotton (Rs25.70) and Al-Abbas Sugar (Rs21.94).

The companies registering significant decreases in their share prices in absolute terms were Rafhan Maize (Rs115.00), Hoechst Pakistan (Rs80.83), Uni-lever Foods (Rs64.85), PIA Holding Co [B] (Rs53.49) and Mehmood Textile (Rs36.46). Mutual funds and individuals turned net sellers as they offloaded shares worth $1.48m and $1.86m, respectively.

Published in Dawn, March 6th, 2025