NEW DELHI, Dec 3: A leading Gulf property developer said on Monday it would team up with a local partner to invest $5 billion in India’s booming real estate sector over the next five years.

A flood of money, especially from the Gulf, has poured into the soaring property market in India, which experts say is among major nations where there is first-time real estate demand rather than only individuals trading up.

RAKEEN, property arm of the Ras Al Khaimah government, said it would form a 50-50 joint venture with India’s Trimex mineral group to spend five billion dollars developing residential, commercial and office space in India.

The new company, RAKINDO Developers, “will have a committed capital outlay of over five billion dollars over the next five years,” said its managing director Prasad Koneru.

“Our entry into real estate estate can’t be better timed. The last 10 years have seen India achieve a transformation process” to create “a booming economy,” he told reporters at the India Economic Summit in New Delhi.

Ras Al Khaimah is part of the United Arab Emirates federation, the world’s sixth largest oil exporter.

RAKINDO “will deliver truly world-class products,” said Khatar Massad, advisor to the Emirate’s crown prince.

The announcement came as giant Dubai-based real estate developer Emaar MGF said it would launch its initial public offering (IPO) to raise $1.7 billion early next year.

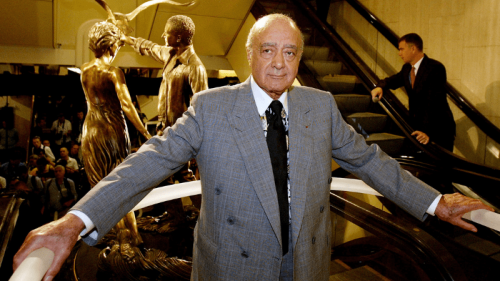

“We’re expecting the IPO to happen in early January,” said Mohamed Ali Alabbar, chairman of Emaar Properties, the world’s biggest real estate firm by market capitalisation.

Emaar MGF, a joint venture of Emaar Properties and India’s MGF Development, plans to spin off a 10 per cent stake and filed its draft prospectus for the share issue in September.

“India is the greatest candidate for us to grow, there are great opportunities (in) shortages of infrastructure and housing,” Alabbar said.

India has attracted a surge of overseas property investment since it allowed foreign capital into the sector two years ago.

Emaar’s share sale plans come after India’s DLF, owned by real estate tycoon Kushal Pal Singh, raised 2.25 billion dollars earlier this year in one of the country’s biggest ever IPOs.

Rakindo said it would “develop on a conservative basis 50 million square feet of residential, commercial and office space” in smaller centres.

Fifty per cent of the money invested would be raised as debt in India and 50 per cent would be equity.

The company said it will start out by beginning construction of a $1.5-billion township and information technology Special Economic Zone (SEZ) near Coimbatore in southern India in early 2008.

Thanks to an economy which has grown at 8.6 per cent annually for the last four years there is hot demand for properties, analysts say.

Last month Damac Properties, another Dubai-based developer, said it would invest as much as five billion dollars in India over the next three year.

For Gulf investors, India looks especially alluring, said Emaar’s Alabbar.

“India is only an hour away from us, it is our true China and with the size, population, the culture, the economic policies, growth that exist in India, it’s a great opportunity.” Gulf commentators also say with the huge leap in oil prices and India’s more liberal policies toward foreign capital, regional investors are looking at India with fresh eyes.

“They have got huge amounts of money to invest. India is opening up as a destination and they are going for it,” said Faysal Abou Zaki, deputy editor-in-chief of Dubai’s Al-Iktissad Wal-Amaal newspaper.—AFP

Dear visitor, the comments section is undergoing an overhaul and will return soon.