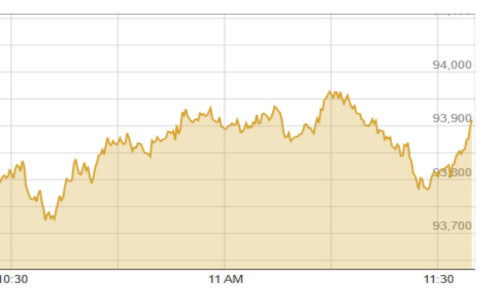

LONDON, Dec 15: Oil prices soared in volatile trading this week on news of falling US supplies and forecasts of higher demand for crude next year.

OIL: Oil prices jumped by more than four dollars Wednesday as traders reacted to news of falling US energy reserves and central banks’ coordinated measures to ease tight credit conditions.

Prices climbed after the US Department of Energy (DoE) said US stockpiles of distillates, including heating fuel, fell by 800,000 barrels in the week ended Dec 7.

The market had expected a gain of 500,000 barrels. Distillates are under close scrutiny during the northern hemisphere winter when heating fuel demand increases.

The DoE said crude inventories dropped by 700,000 barrels, broadly in line with consensus forecasts for a drop of 750,000 barrels.

Prices were also supported following a coordinated move by major central banks to inject more liquidity into global financial markets.

The plan, announced by the central banks of Britain, Canada, the eurozone, Switzerland and the United States, helped ease concerns about an economic slowdown, which would likely dampen demand for energy.

The central banks’ plan provided a breath of economic optimism, said Antoine Halff, an analyst at Fimat.

On Tuesday, crude futures had jumped by about two dollars as traders viewed the US Federal Reserve’s quarter-point cut in interest rates as stimulating the US economy and boosting energy demand.

After rises early in the week, oil prices tumbled about two dollars on Thursday as traders turned sceptical about the success of the coordinated central bank action.

They rebounded on Friday, however, on expectations of higher demand for crude in 2008 as the International Energy Agency and Opec raised their estimates for global oil demand next year.

The International Energy Agency raised its forecast for world oil demand for next year by 115,000 barrels per day because of demand from emerging economies.

The Organisation of Petroleum Exporting Countries also raised its estimate for world oil demand growth in 2008, owing to fast-growing demand for transport and industrial fuel in developing countries.

New York’s main oil futures contract, light sweet crude for delivery in January, jumped to $91.45 Friday from $88.50 a week earlier.

Brent North Sea crude for January rose to $92.08 from $88.62.

PRECIOUS METALS: Gold and silver fell on the back of the strengthening dollar, while palladium and platinum held firm.

A stronger US unit discourages demand for dollar-priced commodities because it makes them more expensive for buyers using weaker currencies.

However, gold found limited support as investors sought a safe haven for their investments amid ongoing volatility on world financial markets.

On the London Bullion Market, gold prices fell to $789.50 an ounce at Friday’s late fixing, from $792.50 a week earlier.

Silver slid to $14.01 an ounce from $14.44.

On the London Platinum and Palladium Market, platinum rose to $1,462 an ounce at the late fixing Friday from $1,458 a week earlier.

Palladium increased to $346 an ounce from $344.

BASE METALS: Base metals prices fell further amid heightened concerns over global economic growth going forward, analysts said.

Price action continues to be choppy with the base metals bearing the worst of the brunt of speculative selling across the commodities complex owing to their close linkage to the economic cyclesaid Barclays Capital analysts.

Concerns over credit markets, of a slowdown in the US economy and the state of the US housing market and volatile equity markets (are) all driving near-term sentiment and price direction, they added.

On Friday, the price of copper for delivery in three months sank to $6,495 a ton on the London Metal Exchange from $6,860 a week earlier.

Three-month aluminium prices weakened to $2,415 a ton from $2,466.

Three-month nickel declined to $26,000 a ton from $26,900.

Three-month lead slid to $2,450 a ton from $2,665.

Three-month zinc slipped to $2,320 a ton from $2,395.

Three-month tin dropped to $16,100 a ton from $16,688.

COCOA: Cocoa prices rose, reaching the highest level since July, as strikes badly affected production from key exporter Ivory Coast.

Standard Chartered analyst Abah Ofon said the strikes came at an ideal time for cocoa producers with strong demand for the commodity from chocolate makers.

From the producer side, it is a good time to be striking as we’re seeing good seasonal demand, Ofon said.

By Friday on the LIFFE, London’s futures exchange, the price of cocoa for March delivery rose to 1,047 pounds a ton from 1,036 pounds last week.

On the New York Board of Trade (NYBOT), the March cocoa contract increased to $2,072 a ton from $2,062.

COFFEE: Coffee prices advanced in London and New York, supported by forecasts of tight supplies and vigorous demand in the 2007/2008 crop year.

By Friday on the LIFFE, Robusta quality for January delivery jumped to $1,840 a ton, compared with $1,754 the previous week.

On the NYBOT, Arabica for March delivery rose to 133.30 US cents a pound from 129.80 cents the previous week.

SUGAR: Sugar prices were higher but gains were limited by the prospect of a large surplus this year.

By Friday on the LIFFE, the price per ton of white sugar for March delivery rose to 298.50 pounds from 290.60 pounds the previous week.

On the NYBOT, the price of unrefined sugar for March delivery stood at 10.30 US cents a pound, up from 9.92 cents the previous week.

GRAINS AND SOYA: Prices bounded higher on keen demand and limited supplies.

Wheat is still performing very well, said Allendale analyst Joe Victor.

Even with higher prices, export demand and domestic demand continue to go higher, and now the United States is dealing with the tightest wheat stocks in more than 60 years. By Friday on the Chicago Board of Trade, the price of maize for March delivery rose to $4.36 a bushel from $4.17 the previous week.Wheat for March delivery was at $9.49 a bushel, up from $9.21.

January-dated soyabean meal -- used in animal feed -- rose to $11.48 from $11.19.

On the LIFFE, the price per ton of wheat for May delivery stood at 181 pounds.

RUBBER: Rubber prices rose this week as supplies tightened after weather conditions worsened in key Asian producers.

It’s because of the rain. There is a shortage of raw material, said rubber dealer Robert Chai at Intracom.

Malaysia has been badly hit by widespread floods after torrential rain which also affected the south of Thailand -- the world’s largest producer.

On Friday, the Malaysian Rubber Board’s benchmark SMR20 rose to 247.40 US cents per kilogramme from 235.95 cents the previous week.—AFP

Dear visitor, the comments section is undergoing an overhaul and will return soon.