HONG KONG, April 9: Asian stocks closed mostly down on Wednesday with China tumbling more than five percent amid concerns about the US economy and ballooning losses from the global financial crisis.

Chinese stocks slid 5.5 per cent, giving up strong gains from earlier in the week. Hong Kong, Australia and Singapore all fell around one per cent or more, although Indian shares bucked the trend to close in the black.

Indonesia led the decline among smaller markets, falling more than three percent. But Malaysia managed a small gain.

Investors were unnerved after the International Monetary Fund said Tuesday worldwide losses stemming from the US subprime mortgage crisis could hit close to one trillion dollars.

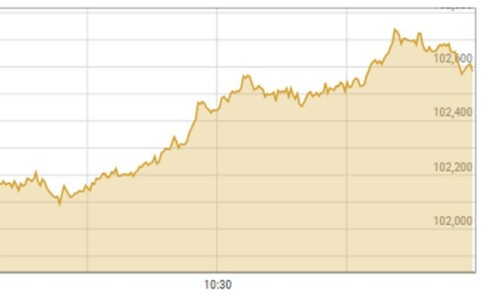

TOKYO: Japanese share prices closed down 1.05 per cent as investors took profits amid jitters about corporate earnings and a stronger yen, dealers said.

The benchmark Nikkei-225 index fell 138.54 points to end at 13,111.89. The broader Topix index of all first-section shares shed 19.79 points or 1.54 percent to 1,262.90.

Decliners outnumbered gainers 1,245 to 378, with 96 issues unchanged.

Volume rose to 1.83 billion shares from 1.69 billion Tuesday.

HONG KONG: Hong Kong share prices closed down 1.35 per cent, dealers said.

The Hang Seng index closed down 327.12 points at 23,984.57. Turnover was 83.41 billion Hong Kong dollars (10.71 billion US).

YK Chan, a strategist with Phillip Capital Management, said the tumble on Shanghai had dampened sentiment. China-related financials and commodities posted sharp losses and led the falls, he said.

SYDNEY: Australian share prices closed down 0.9 per cent, dealers said.

The benchmark S&P/ASX 200 fell 51.3 points to 5,520.2, while the broader All Ordinaries index fell 50.9 points or 0.9 per cent to 5,583.5.

Market volume was 1.2 billion shares traded worth 4.8 billion dollars (4.5 billion US).

Dealers said the market was concerned at data showing consumer sentiment dropped 1.3 percent in April to its lowest level since June 1993.

SINGAPORE: Singapore share prices closed 1.30 percent lower, dealers said.

The blue chip Straits Times Index fell 40.70 points to 3,089.72 on volume of 1.59 billion shares worth 1.58 billion Singapore dollars (1.14 billion US).

DBS Group fell 16 cents to 19.30 Singapore dollars. CapitaLand dropped 16 cents to 6.53. Singapore Airlines fell 20 cents to 15.90.

KUALA LUMPUR: Malaysian share prices closed up 0.2 per cent, dealers said.

The Kuala Lumpur Composite Index finished up 2.03 points at 1,227.74 with a lean 431 million shares traded, worth 1.1 billion ringgit (346 million dollars).

JAKARTA: Indonesian share prices closed 3.1 per cent lower, dealers said.

The Jakarta Composite Index was down 69.68 points at 2,180.09. “Investors are worried that rising inflation may force the central bank to raise its benchmark rate later this year,” said Valbury Asia Securities analyst Mastono Ali.

Bank Mandiri lost 5.4 per cent to 2,650 rupiah. Bumi Resources dropped 2.6 per cent to 5,550 rupiah. Astra International lost 3.8 per cent to 17,650 rupiah.

Telkom lost 2.7 per cent to 9,000.

WELLINGTON: New Zealand share prices closed 0.85 per cent lower, dealers said.

The NZX-50 Index ended 30.23 points lower at 3,575.45 on turnover worth 147.70 million dollars (116.61 million US).

It was “another down day, reflecting European and US markets and today all the Asian markets,” ASB Securities broker Stephen Wright said.

Telecom fell 11 cents to 3.80 dollars. Fletcher Building lost 12 cents to 8.30 dollars. Contact Energy gained six cents to 8.63.

MUMBAI: Indian share prices closed up 1.3 per cent, dealers said.

They said local sentiment improved on expectations that the ruling Congress government would not allow inflation and food prices to spiral out of hand.

The benchmark Mumbai Sensex index rose 202.89 points to 15,790.51.—AFP

Dear visitor, the comments section is undergoing an overhaul and will return soon.