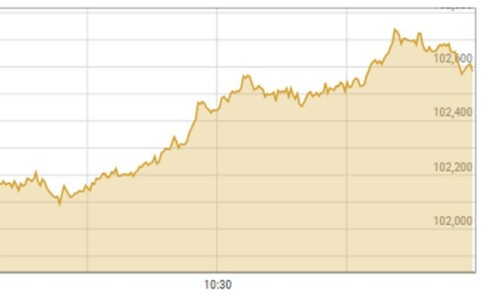

KARACHI, April 10: The KSE 100-share index on Thursday reacted violently to the Wednesday’s city violence and arson incidents as panicked investors indulged in hasty selling fearing further deterioration in the law and order situation. At one stage it was down by 230 points but ended sharply recovered with a net fall of 99.25 points at 15,304.92.

But after mid-session, investors were back in the market and covered positions at the lower levels on the blue chips counters, notably cement and leading insurance shares and blue chips, limiting the decline.

The index’s rebound from the initial low of 15,178.67, off 230 points reflects that the market is capable of absorbing snap shocks on its inherent strength amid analysts’ predictions that the long-term outlook remains bullish.

It finally finished with a fall of 99.25 points at 15,304.92 as compared to previous 15,404.17 a day earlier. The free-float 30-share index followed it off 71.71 points at 18,656.42.

The rebound was supported by active short-covering at the lower levels in leading shares, notably D.G. Khan Cement, Nishat Mills, Engro Chemical and some others, which rose from the early lows.

“City violence apart, the market sentiment initially was also weighed down by two opinions about the capital gain tax and withholding tax linked to share business,” said a leading analyst Ahsan Mehanti, adding, “Whether or not both are withdrawn or a status quo would be maintained is the chief worry of the investors”.

Ashraf Zakaria, another analyst, says the market stance during the post-election weeks showed that investors were not inclined to entertain bearish ideas till the dividend announcements for the year ended on March 31, are made.

Its strong rebound after each dip reflects that a section of investors apparently vowed to the keep index level above 15,000 points even in most trying conditions, he added.

However, minus signs dominated the list under the lead of AKD Capital and Nestle Pakistan, off by Rs21 and 75 followed by Arif Habib Securities and Arif Habib Ltd, Adamjee Insurance, Pakistan Refinery, Attock Petroleum, Dadex Eternit, Dawood Hercules, Unilver Pakistan, Pakistan Services and AKD Capital, off by Rs6.25 to Rs21.

But on the other hand Bata Pakistan and Siemens Pakistan managed to finish higher by Rs30 and 43. Other prominent gainers included EFU General, JS & Co, National Refinery, International Industries, National Foods, Pakistan Engineering, Fazal Textiles and New Jubilee Insurance, which posted gains ranging from Rs7 to Rs26.30.

Traded volume was maintained above the 300m share mark at 305m shares but losers maintained a fair lead over the gainers at 217 to 93, with 23 shares holding on to the last levels.

The most active list was topped by D.G. Khan Cement, sharply higher by Rs3.65 at Rs118.05 on 32m shares followed by Fauji Fertiliser Bin Qasim, lower by Rs2.10 at Rs40.85 on 27m shares, Nishat Mills, higher by Rs5.20 at Rs129.70, Arif Habib Securities, sharply lower by Rs8.50 at Rs178 on 17m shares, and Lucky Cement, up 95 paisa at Rs144.95 on 14m shares.

Engro Chemical followed them, lower by Rs1.65 at Rs357.10 on 10m shares, Pakistan Oilfields, sharply lower by Rs5 at Rs375 also on 10m shares and Bank Islami Pakistan, easy by 40 paisa at Rs19.35 on 8m shares, NIB Bank, off 65 paisa at Rs18 on 11m shares and Azgard Nine, up Rs1.05 at Rs74 on 8m shares.

FORWARD COUNTER: D.G. Khan Cement also led the list of actives on the cleared list, up by Rs4.70 at Rs118 on 11m shares, followed by Nishat Mills, higher by Rs4.35 at Rs129.95 on 9m shares and Arif Habib Securities, sharply lower by Rs7.50 at Rs179.50 on 6m shares.

Lucky Cement followed them, up 60 paisa at 145 on 6m shares and Engro Chemical, up Rs1.20 at 357.20 on 5m shares.

DEFAULTER COS: Norrie Textiles again came in for active support and rose one rupee at Rs3.60 on 2.437m shares followed by Japan Power, lower 15 paisa at Rs7.25 on 0.312m shares and Zeal Pak Cement, easy by five paisa at Rs4 on 0.303m shares. National Asset Leading was held unchanged at 85 paisa on 0.951m shares.

Dear visitor, the comments section is undergoing an overhaul and will return soon.