WITH reference to Mr Yousuf Nazar’s article, ‘Making peace with powerful brokers’ published in the Economic & Business Review on Monday, June 9, the issue of imposition of capital gains tax needs to be seen in the light of its practical implications and the existing ground realities.

WITH reference to Mr Yousuf Nazar’s article, ‘Making peace with powerful brokers’ published in the Economic & Business Review on Monday, June 9, the issue of imposition of capital gains tax needs to be seen in the light of its practical implications and the existing ground realities.

If imposed, capital gains tax would have been levied on all investors in the capital markets and not on stock-brokers; consequently, the debate should be on whether this is an appropriate tax on capital markets as opposed to limiting the discussion to stock brokers..

Banks are already subject to capital gains tax at normal income tax rate on their income from equity markets. Trading tax exists on all trading incomes of every investor.

The volume in our equity markets is a mixture of long-term investment and short-term trading; continuing funding provide an innovative form of financing that allows retailers to participate in the market and add to price-discovery and efficiency.

In other markets, leveraged plays take place in derivative markets; so comparison of Pakistan cash market with other country’s cash market is not appropriate as their speculative markets are far more volatile than ours.

Thee capital markets are subject to the following taxes: corporate tax on listed companies; CVT at the rate of 0.02 per cent; presumptive withholding tax on commission (buy) at 0.01 per cent; presumptive withholding tax on commission (sell) at 0.01 per cent; withholding tax on sale at 0.01 per cent (adjustable); withholding tax on Carry Over Trade at 10 per cent on premium (adjustable); and dividend tax at 10 per cent.

A presumptive tax regime is a very efficient means of collecting taxes that is fully documented. With no interface between the government and the tax payer, the cost of tax collection is low..

Currently, withholding tax on sale and withholding tax on carry over trade are adjustable taxes. These taxes are collected from customers and financiers. A major problem faced by the government is that the above taxes are not final tax liability and are therefore adjustable or refundable against the final tax liability of the customer or the financier. Additionally, verification and assessment of the amounts paid are time consuming and costly, and very difficult.

As the capital gains tax is an adjustable tax, its collection will prove to be extremely costly to the government and it is quite possible that the cost of collecting and verifying the amount of CGT received will exceed the amount collected. Replacing CVT with CGT will result in a significant fall in tax collection from capital markets

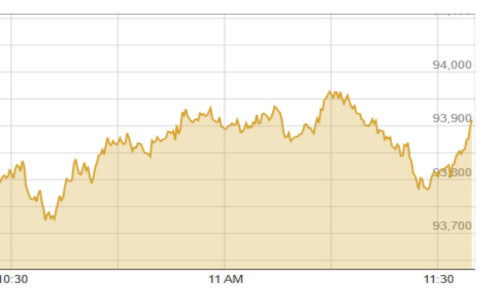

Currently, it is expected that the government this year will collect around Rs4.5 to Rs5 billion in taxes from the KSE through CVT and other direct taxes. This contribution has been growing at a CAGR of 25 per cent.

Current taxes are levied on a transaction basis and not on the nature of the transaction. In the case of the CGT, tax is levied only if a trade is profitable, and will result in lesser collections by the government. Imposition of taxes based on profitability would also mean that those transactions where profits are not earned, shall also become sources of claims for tax refunds.

A capital gains tax would make Pakistan un-competitive with other jurisdictions for which it competes for global portfolio investment. Most international fund managers have confirmed to us that they would not enter the Pakistani market if the capital gains tax is imposed. Additionally, those fund managers who currently have sizeable holdings in the stock market have indicated that they would exit the market should a capital gains tax be imposed.

A committee has been formed by the government to develop a long –term road map/capital market policy. A key term of reference for the committee is a long- term taxation policy that is progressive and sustainable. And in this connection talks have been held between various stakeholders including the stock brokers with the government. These included representatives of Mutual Fund industry , corporate brokerage houses and investment banks.

Capital markets play a key role in the country’s economy. They are catalyst of growth, investment and consumer confidence. They need encouragement.

The writer is managing director, Karachi Stock Exchange.

Dear visitor, the comments section is undergoing an overhaul and will return soon.