Soon after the nationalisation of Northern Rock in the UK and takeover of Bears Stern by the US earlier this year, I had asked in one of my columns, if the age of market has come to an end.

Soon after the nationalisation of Northern Rock in the UK and takeover of Bears Stern by the US earlier this year, I had asked in one of my columns, if the age of market has come to an end.

Since then a lot of water has flown under the bridge. Almost every month since one major multinational financial institution or the other facing bankcruptcy has been rescued by the tax payers money in the US and the UK, the world’s capitals of capitalism. Last week it was the turn of Lehman Brothers and the AIG in the US and HBOS (Britain’s biggest savings bank) in the UK.

The crisis in the HBOS has led the Bank of England to extend its Special Liquidity Scheme (SLS) to banks. The SLS allows banks to swap hard-to-trade securities linked to past mortgage lending for easier-to-sell Treasury bills issued by the government.

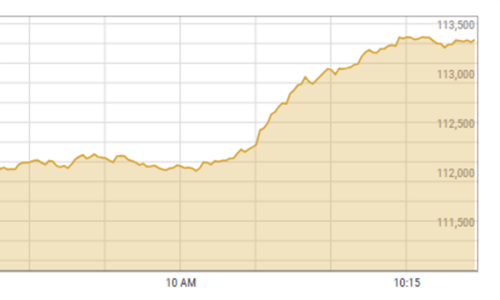

Since the last Monday, when Lehman filed for bankruptcy, HBOS shares have fallen by as much as 68.7 per cent as investors dumped stock on fears about the bank’s exposure to the mortgage market and its ability to secure funding.

In a statement the FSA said: “Since the beginning of the current extreme difficulties in the financial markets, the Financial Services Authority has worked intensively with all major UK banks to ensure they have credible capital and liquidity plans. “We are satisfied that HBOS is a well-capitalised bank that continues to fund its business in a satisfactory way”.

As Lloyds’ was preparing to take over HBOS in the UK the US, Federal Reserve was trying overnight to save American International Group (AIG), one of the world’s biggest insurers, from the brink of collapse after America’s central bank agreed an $85 billion (£47 billion) bailout.

The rescue gives the US government a 79.9 per cent stake in the insurer. The central bank hopes that the rescue loan will halt plummeting financial markets, reeling from the collapse of Lehman Brothers and sale of Merrill Lynch. Market economy seems to have gone out of control threatening the bastions of capitalism.

And it did not come as any surprise when David Cameron, Britain’s Conservative leader sounded the warning bell. He has actually called on what he termed as ‘centre-right’ leaders across the world to unite to defend capitalism, ironically warning them at the same time that the left could use the banking crisis as an excuse to “wreck” the financial services sector.

“We must not let the left use this as an excuse to wreck an important part of the British and world economy,” Mr Cameron told the Financial Times after discussing the market chaos with Angela Merkel, the conservative German chancellor, in Berlin.

But ain’t those very people who are using tax payers money to save the financial institutions across the rich world from bankcruptcy, doing what Mr. Cameron fears the left would do to ‘wreck’ the financial sector?

Free market has found a number of ways to bypass even the stringent regulations and it will continue to do so no matter what the ‘centre-right’ leaders of the world do to defend capitalism. And that would one day soon lead these leaders to give up and when they do that perhaps they would see the advantages in the system of economy that China has fostered since early 1980s.

Meanwhile, the total number of unemployed in the UK rose by 81,000 to 1.7 million, pushing the unemployment rate to 5.5 up from 5.3 per cent, according to official figures released midway through last week. The number of people claiming unemployment benefit also rose by more than 32,500 to more than 900,000 last month, the seventh monthly rise and the biggest increase for almost 16 years.

The last time unemployment topped two million was in 1997 as Labour came to power. Wednesday’s official figures also reported the first fall in total employment since the beginning of 2007. The number of people in work during the three months to the end of July dipped by 16,000 to 29.54 million.

Understandably, the number of jobs available in the finance and business services sector – now almost collapsing – during the three months to the end of August were more than 19 per cent lower than the same period a year ago.

As demand for housing went down, vacancies in construction went down 18.5 per cent. The number of jobs available in the shops, hotels and restaurants sector was also sharply down as faltering consumer confidence spread.

The latest Bank of England Agents survey has found signs of falling retail sales and spending on consumer services, along with signs that business investment is also weakening.Clear signal that the economy is weakening. Demand for new and used cars also fell, with dealers citing waning consumer confidence and higher financing costs. In a related development manufacturing output growth declined over the month while capacity constraints also declined, suggesting that slack is building up in the economy.

The outlook for the UK’s manufacturing sector appears to be worsening as the Confederation of British Industries’ monthly Industrial Trends Survey for September showed a sharp deterioration in total order book levels.

Dear visitor, the comments section is undergoing an overhaul and will return soon.