HONG KONG, Sept 22: Shares in Asia mostly rose on Monday as dealers reacted positively to the US government’s rescue package for the financial sector, while some markets were also boosted by domestic regulatory measures.

However, continued concern over the US Treasury’s move to ask Congress for authority to spend $700 billion on bad mortgage-related assets from financial institutions kept some rises modest, analysts said.

The markets that saw the biggest gains -- Australia and China -- both benfitted from domestic measures on top of Friday’s Wall Street rally that greeted the rescue plan.

Australian shares closed up 4.5 per cent after the corporate regulator banned all forms of short selling in a bid to curb volatility.

Japanese shares closed up 1.42 per cent, below intra-day highs, as markets digested the US plan to mop up Wall Street’s billions of dollars of bad debt, dealers said. The market was also boosted by another 1.5 trillion yen (14 billion dollars) injection from the Bank of Japan, on top of the 11 trillion pumped in last week.

Asia’s largest bourse was cautious ahead of a national holiday Tuesday and uncertainty over the plan to buy the toxic mortgage-related assets of US financial institutions.

TOKYO: Japanese shares rose 1.42 per cent, dealers said.

Asia’s largest bourse was cautious ahead of a national holiday in Japan Tuesday and uncertainty over the $700-billion rescue plan to buy the toxic mortgage-related assets of US financial institutions, they added.

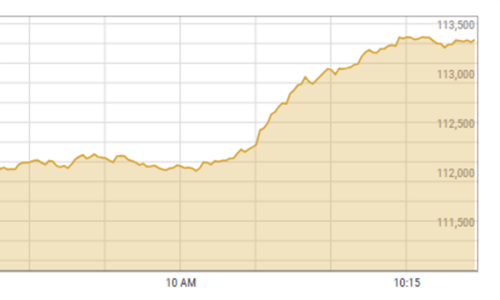

The Tokyo Stock Exchange’s benchmark Nikkei-225 index closed up 169.73 points to 12,090.59. The broader Topix index of all first-section shares rose 19.57 points or 1.70 per cent to 1,168.69.

Equities dealers “may have to come down to Earth and realise the enormity and complexity of the rescue plan. The devil is in the details” and Congress may baulk at the total costs, said analysts at Singapore brokerage CIMB.

HONG KONG: Shares prices closed 1.6 per cent up, dealers said.

The benchmark Hang Seng Index soared 304.47 points to 19,632.2. Turnover was 91.63 billion Hong Kong dollars (11.75 billion US).

But analysts said the index will likely fall on profit-taking in the near term after rising 21 per cent since last Thursday.

Oil firm CNOOC jumped 5.99 per cent and aluminium company Chalco was up 5.26 per cent.

SYDNEY: Australian share prices closed up 4.5 per cent, dealers said.

The benchmark S&P/ASX 200 was up 216.4 points at 5,020.5 while the broader All Ordinaries rose 209.4 points to 5,050.1.

Turnover reached 1.6 billion shares worth a total of 7.28 billion dollars (6.05 billion US), while 704 stocks closed up, 382 down and 308 unchanged.

Macquarie Equities associate director Lucinda Chan said the US 700 billion dollar rescue package had created a very positive market sentiment.

SINGAPORE: Shares closed 0.58 per cent lower, dealers said.

They said initial investor optimism over the US Treasury bailout turned to caution.

The blue-chip Straits Times Index fell 14.94 points to 2,544.13. The index had risen more than one per cent in early trade.

Volume was 1.52 billion shares worth $1.74 billion (US$1.23 billion).

Losing issues edged gainers 276 to 260 with 814 unchanged.

KUALA LUMPUR: Malaysian share prices rose 0.3 per cent, dealers said.

The Kuala Lumpur Composite Index rose 2.92 points to close at 1,028.62.

Plantation company IOI Corp rose 7.4 per cent to 4.66 ringgit while gaming giant Genting inched up two per cent at 5.10 ringgit.

State telecommunications company TMI dropped 6.9 per cent to 6.10 ringgit.

JAKARTA: Indonesian shares closed up 0.3 per cent, dealers said.

The Jakarta Composite Index finished at 1,837.34.

Bank Rakyat Indonesia rose 5.4 per cent to 5,900 rupiah, Bank Mandiri gained 4.7 per cent to 2,800 while coal miner Bukit Asam fell 3.8 per cent to 10,100.

WELLINGTON: New Zealand share prices leapt 2.15 per cent, dealers said.

The benchmark NZX-50 index gained 68.59 points to 3,255.72.

Market leader Telecom rose 10 cents to 2.82 dollars and Fletcher Building surged 34 cents to 7.32.

Contact Energy rose 13 cents to $8.70 .

MUMBAI: Indian shares fell 0.34 per cent, dealers said.

The BSE benchmark 30-share Sensex index fell 47.36 points to 13,994.96.—AFP

Dear visitor, the comments section is undergoing an overhaul and will return soon.