NEW YORK, Oct 6: Governments and central banks around the world grasped at measures to contain the fast-spreading financial crisis on Monday but global stocks still plummeted as investors bet a recession was inevitable.

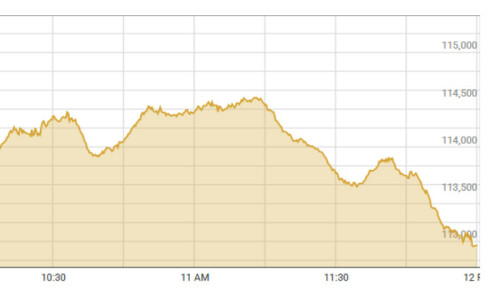

A fragmented response from Europe led top US officials to call for a “forceful and coordinated” global reaction as the Dow industrials fell 764.38, or 7.40 per cent, to 9,561.00. It is the first time the Dow has traded below 9,700 for the first time since November 2003.

The Standard & Poor’s 500 Index skidded 82.19 points, or 7.48 per cent, to 1,017.04, while the Nasdaq Composite Index slid 158.73 points, or 8.15 per cent, to 1,788.66.

The FTSE 100 and the FTSEurofirst indexes each fell nearly 8 per cent and investors fled to safe havens.

Emerging markets, which had gained most from the boom in commodities demand and surging global expansion in the last three years, were also sucked into the vortex. Trading was halted in markets as far afield as Brazil and Russia when their indexes nosedived 15 per cent.

“This is a stampede,” said Valerie Plagnol, chief strategist at CM-CIC Securities in Paris.

French President Nicolas Sarkozy issued a statement from the 27 member states of the European Union saying individual countries would do all they could to safeguard the financial system while euro zone finance ministers gathered in Luxembourg in an attempt to attack the crisis in unison. But some analysts were pessimistic that European powers could stop the contagion.

The banking upheaval that began on Wall Street has effectively shut down inter-bank and other loan markets, pushing industrialised countries closer to recession. Conditions remained poor for inter-bank lending.

Even as Sweden, Austria and Denmark followed Germany’s lead by offering guarantees to savers, investors from Tokyo to London continued to slash risk from portfolios and positioned themselves for a further tightening of credit and bank lending.

South Korea said it wanted crisis talks with Japan and China and Gulf equities crumbled under concerns the fallout would strike the region.

Lost in the avalanche of bad news was the continued drop in the price of oil, which fell below $90 a barrel. That was a dose of relief amid deteriorating macroeconomic signs including another 159,000 jobs lost in September, the ninth straight monthly reduction and the deepest in 5-1/2 years.

With the US presidential election less than a month away and the financial system coming to grips with a massive government intervention in America’s free markets, the country was sorting out how it would confront the worst banking crisis since the Great Depression.

Bailout programme

Still unresolved was who would run the US Treasury Department’s $700 billion programme to buy degraded debt in a bid to free up new lending by financial institutions that have been crippled by underperforming mortgages. The Wall Street Journal reported that Assistant Secretary for International Affairs Neel Kashkari would oversee it.

In Texas, President George W. Bush said it would take time to restore confidence in the financial system and free up credit, telling reporters it was important that the rescue programme did not waste taxpayer money.

“We don’t want to rush into this situation and not have the programme be effective. ... The one thing people can be certain of is that the bill I signed is a big step toward solving this problem,” Bush said.

Experts from the markets to the think tanks remained divided over who was responsible for the train wreck that unfolded before the world’s eyes and whether the unprecedented US intervention was a boondoggle or a necessary evil.

The disgraced head of Lehman Brothers Holdings Inc told Congress that US banking regulators knew exactly how Lehman was pricing its distressed assets and about its liquidity in the months before its collapse.

In a panel discussion in Chicago, former US Securities and Exchange Commission chief Richard Breeden called the crisis “a 900-foot tsunami” and chided Treasury Secretary Henry Paulson for wanting, as recently as a year ago, to reduce regulation.

In Europe’s sudden transformation of its banking sector, France’s BNP Paribas agreed to scoop up assets in Belgium and Luxembourg of banking and insurance group Fortis for 14.5 billion euros ($20.1 billion) to become the euro zone’s biggest deposit bank.

Germany abandoned plans to handle its domestic banking problems on a case-by-case basis and is now considering a nationwide umbrella to shield its entire financial industry.

Trading in shares of Italy’s UniCredit was suspended several times as volatile trading greeted the bank’s abrupt U-turn decision to boost capital by 6.6 billion euros.—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.