KARACHI, Oct 20: The State Bank of Pakistan on Monday announced a rescue package of Rs33 billion to avert any sharp fall of the stock market after the removal of the ‘floor’ from under the KSE-100 share index on October 27.

The central bank decided that the existing facilities of “financing against shares to members of stock exchange” outstanding as on August 31, 2008 will be converted into a Term Finance Facility of one year. Banks had lend Rs33 billion to the stock brokers till August 31.

The borrowers, during the term of the facility, can repay the amount but no fresh disbursement under this facility will be allowed.

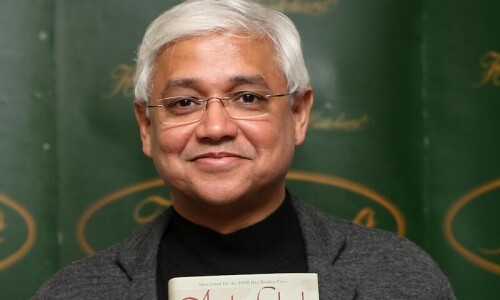

These decisions were taken in a meeting chaired by SBP Governor Dr Shamshad Akhtar and participated by banks and brokers here on Monday.

It also decided that in addition to shares, the banks may also accept other types of collateral like residential plots, houses, etc., to secure existing financing against shares to brokers.

This additional collateral may be provided by brokers if the value of marketable securities is not sufficient or to create sufficient cushion in the margin in case of further market decline.

Stock brokers are eager to get financing as the market is completely dry but the banks are reluctant to enter the shares market globally under serious turmoil and the most risky area for the banks to park their liquidity.

The SBP said the objective of this arrangement was to avoid unnecessary margin calls in case of market decline during first few days after the floor is lifted.

At present, the exposure against shares is subject to a minimum margin of 30 per cent. Banks are required to give a margin call when the margin breaches this limit. It was decided that while at the start of the facility the minimum margin may continue to be 30 per cent, but banks may not give a margin call until the margin breaches 25 per cent limit.

“It was agreed in the meeting that banks may also consider accepting the membership card of brokers as collateral subject to the fulfilment of all requisite legal formalities and necessary approvals,” said a statement issued by the SBP.

The banks have been given two limits for exposure against shares; Ready market (20 per cent of the equity for banks; for Islamic banks and for DFIs which are mobilising deposits, the limit is 35 per cent) and an additional 10 per cent against exposures in Futures contract.

Dear visitor, the comments section is undergoing an overhaul and will return soon.