LONDON, Nov 19: Platinum held firm after rising as much as 3 per cent on Wednesday after an industry report predicted demand could still rise and a mine closure triggered short covering, while gold was steady.

Precious metals traded rangebound, keeping an eye on the currency markets, as the dollar inched up against a basket of currencies while falling oil prices capped possible gains of bullion.

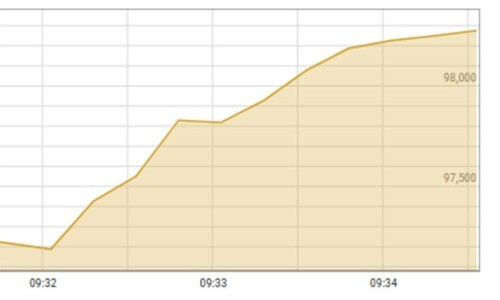

Platinum was trading at $829.00 an ounce by 1055 GMT after hitting a session high of $850 an ounce earlier and compared with $824.50 an ounce in New York late on Tuesday, when it gained around 2 per cent.

Platinum has risen on the combination of short-covering and people taking the Johnson Matthey report as not perhaps being as bearish as they might have seen, Tom Kendall, precious metals strategist at Mitsubishi Corp, said.

Precious metals refiner Johnson Matthey said global demand for platinum catalytic converters would climb 2 per cent in 2008 on higher consumption in Europe and emerging economies, despite a sharp decline in North America.

But analysts do not expect a major recovery in the platinum price as the demand from the auto sector, which has been severely affected by the global downturn, remains key.

More than 60 percent of global platinum use goes to auto catalysts to clean exhaust fumes.

Yukuji Sonoda, precious metals analyst at Daiichi Commodities in Tokyo, said Johnson Matthey’s price range of $700 to $1,400 an ounce for platinum was reasonable but demand remained in doubt. There's no actual demand at this moment.

Jewellery and auto companies are not buying. Despite the gains, fears about the future of the financially ailing General Motors weighed on the market and could trigger another bout of selling, he said.

Platinum roared to a record $2,290 in March as a power shortage in main producer South Africa disrupted mining.

But prices have tumbled since then on deteriorating car sales, and platinum also tracked declines in gold as fears about the global economic slowdown deepened.

Gold, whose movements often dictate platinum, held near New York levels. Spot gold was trading at $736.05 an ounce versus $736.35 an ounce in New York late on Tuesday.—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.