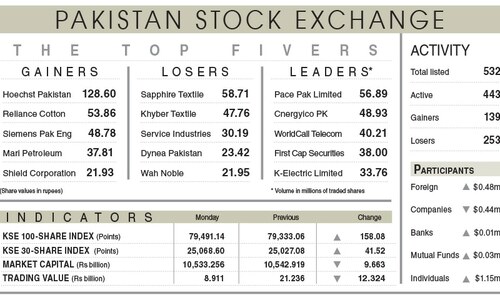

KARACHI, Jan 5: The share market maintained an uppish leaning on Monday on active follow-up support by the institutional traders and analysts predict the process of recovery may continue in the coming sessions on technical grounds alone.

The KSE 100-share index recovered another 124.33 points or 2.15 per cent at 5,917.90, well below the session’s high of 5,954.94, indicating a section of leading investors was still in two minds about the future direction of the market. The KSE All Share and 30-share indexes also recovered 90.95 and 98.55 points at 4,453.64 and 5,439.77 points respectively.

The market is on a turning point as leading base shares, notably PSO, MCB Bank, Adamjee Insurance were the major losers, while some others, OGDC, Pakistan Petroleum, Pakistan Oilfields, Hub-Power and PTCL have assumed the role of future market trend setters.

“It will stay on the slippery path until all of them join hands to consolidate the initial rally on the strength of the current lower levels, which ensure huge capital gains in the given situation,” said a leading analyst Asrahf Zakaria.

He said easing in the prevailing tension with India would add significantly to the market recovery amid revival of new year short-covering.

“Both the attractively lower levels and the fund’s operational activity would play a decisive role in pulling the market out from the prevailing impasse,” said Ahsan Mehanti. An attractive bait of capital gains may not be that easy to ignore at this stage, he added.

But some others said the future market trend will essentially be guided by attitude of foreign investors. If they continue unloading their long positions on the blue chips counters in the coming weeks also, the current rally would falter half way and if they opt to restrain, the current recovery tempo would be sustained.

They linked the extension of weekend rally to strong short-covering in the leading public sector scrips, which form the basis of recently floated State Enterprise Fund, while the blue chips on the other counters remained under pressure.

Mutual Funds, bank, modarabas and leading shares on the other counters led the market advance, leading gainers among them, Habib Bank, New Jubilee Insurance, Mari Gas, Pakistan Petroleum, Millat Tractors, BOC Pakistan, Glaxo-SKF, Abbott Lab, Engro Chemical, Packages and Unilever Pakistan, which posted fresh gains ranging from Rs3.42 to Rs85.

Leading losers were led by Al-Ghazi Tractors, Shell Pakistan, Dawood Hercules and Pakistan Services, which suffered fall ranging from Rs10.00 to Rs19.43 but largest decline of Rs107.46 and Rs53 was noted in Rafhan Maize and Siemens Pakistan, which is under pressure for the last couple of sessions and had fallen sharply lower on some negative news about the earnings for the last year.

MCB Bank, EFU General EFU Life, Pakistan Tobacco, PSO, PECO, Clariant Pakistan and some others also fell by Rs5.47 to Rs7.75.Trading volume was maintained at the previous level of 210m shares, while gainers held a strong lead over the losers at 194 to 75, out of the 269 actives.

TRG Pakistan topped the list of actives, higher by 57 paisa at Rs2.85 on 16m shares, OGDC, up by Rs2.33 at Rs49.27 on 15m shares, NIB Bank, steady by 71 paisa at Rs6.01 on 13m shares, PTCL, firm by 10 paisa at Rs15.61 on 9m shares and Hub-Power, up by Re1 at Rs16.45 on 8m shares.

WorldCall Telecom followed them, up 74 paisa at Rs4.23 on 7m shares, Pak PTA, firm by 14 paisa at Rs2.09 also on 7m shares, MCB Bank, sharply lower by Rs5.30 at Rs108.52 on 7m shares and Pak Strat Fund, up Re1 at Rs2.78 on 6m shares.

FORWARD COUNTER: Leading shares on this counter remained under pressure and fell sharply lower under the lead of MCB Bank, PSO, Adamjee Insurance, but some others ended lower fractionally under the lead of Bank Alfalah, which shed only 28 paisa at Rs15.68, while MCB Bank and PSO shed another Rs5.36 and Rs6.60 at Rs109.89 and Rs125.54 respectively but no transaction was noted in any of them.

DEFAULTER COUNTER: Zeal Pak Cement led the list of actives on this counter, steady by 13 paisa at Rs0.71 on 12.647m shares followed by Japan Power, up 46 paisa at Rs2.37 on 1.477m shares, Mukhtar Textiles, higher by 30 paisa at Rs0.75 on 0.149m shares.

Unity Modaraba followed them, up 16 paisa at Rs0.51 on 0.511m shares, followed by National Asset Leasing, steady by three paisa at Rs0.50 on 0.189m shares and Crescent Standard Modaraba, firm by eight paisa at Rs0.63 on 51,000 shares. Others also rose where changed.

DIVIDEND: Al-Noor Sugar, cash 30 per cent for the year ended Sept 30, 2008.

Dear visitor, the comments section is undergoing an overhaul and will return soon.