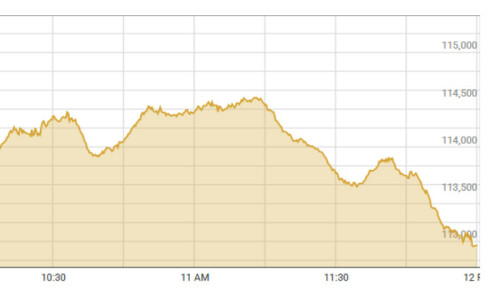

KARACHI, Jan 15: The KSE 100-share index on Thursday plunged by 4.50 per cent or 272.58 points at 5,778.58 points eroding Rs80 billion from the market capital as selling by both the fund managers and the leading brokers was further intensified followed by reports of margin calls and fresh threats by India.

There were many reasons behind the current sell-off, notably the turmoil on the world bourses owing to US recession, liquidity crunch and higher CFS rates, analysts said.

The rout was across-the-board but the buyers have no appetite for capital gains even at the current attractive bait at the current lows.

The KSE 30-share and All Share indexes fell by 5.29 per cent or 307.58 points and 4.20 per cent or 189.18 points at 5,510.47 and 4,315.91 points respectively.

But what worried the prospective investors was the U-turn taken by the managers of State Enterprise Fund who were out to cash in on the available profit margin and pushed the index again below its resistance level of 6,000 points, they added.

“When those assigned the role of putting the market back on the rails and protect the interest of small investors turn sellers, why others should not fallow them,” said a leading broker.

The leading shares, notably OGDC, National Bank and Pakistan Petroleum, which form the new fund portfolio along with six others ran into near-panic profit-selling and led the market retreat, off by 2.73, 3.35 and 7.20 per cent respectively.

“The experiment to revive the sympathetic buying interest on counters beyond the state-owned nine companies, seems to have failed as was reflected by the return of the bears,” analysts said, adding investors may have deeper worries than being speculated by the official sources.

No one could precisely predict at this stage about the future direction of the market but one thing appears certain everyone yearning the return of sanity both to law and order and political front before resuming normal trading activity, they said.

Minus signs again dominated the list under the lead of Rafhan Maize Products, Pakistan Services, Shell Pakistan, Ferozsons Lab and EFU Life, which suffered fall ranging from Rs11.16 to Rs102.08.

Engro Chemical, BOC Pakistan, Dawood Hercules, Clariant Pakistan, Millat Tractors, Al-Ghazi Tractors, MCB Bank, Pakistan Oilfield, Pakistan Petroleum, PSO and Sitara Chemical followed them, off by Rs5.18 to Rs9.06.

An idea of the prevailing panic may well be had from the fact that highest rise of the session was 94 paisa in National Refinery and 68 paisa in Usman Textiles. Some others also rose fractionally by a few paisa under the lead of Balochistan Wheels and Sui Northern Gas.

Trading volume fell to 122m shares from the previous 161m shares as losers held a strong lead over the gainers at 211 to 25, with six shares holding onto the last levels.

OGDC led the list of retreating active scrips, off by Rs2.73 at Rs52 on 9m shares followed by WorldCall Telecom, easy by 41 paisa at Rs3.52 on 8m shares, Pak PTA, lower by 41 paisa at Rs2.08 also on 8m shares, NIB Bank, easy by 68 paisa at Rs5.03 on 6m shares, Pakistan Petroleum, off Rs7.20 at Rs138.07 also on 6m shares and TRG Pakistan, easy 30 paisa at Rs2.44 on 5m shares.

National Bank followed them, easy Rs3.35 at Rs63.74 on 5m shares, PTCL, off Re1 at Rs15 also on 5m shares and Fauji Fertiliser Bin Qasim, off 99 paisa at Rs13.60 on 4m shares.

FORWARD COUNTER: Operation liquidation continued on this counter as most of the shares, which came in for trading fell further under the lead of PSO, Adamjee Insurance, ICI Pakistan and Habib Bank, falling by Rs1.38 to Rs3.74 in that order. But there was no business in any of them.

DEFAULTER COMPANIES: Zeal Pak Cement again led the list of actives, lower by 10 paisa at Rs0.53 on 4.900m shares followed by Unity Modaraba, steady by two paisa at Rs0.28 on 0.257m shares and S. S. Oils, off 23 paisa at Rs2.98 on 67,500 shares.

Japan Power followed them, lower 24 paisa at Rs1.61 on 0.497m shares, Quice Foods, National Asset Leasing, and Pangrio Sugar also eased by 20 to 43 paisa on light volumes.

Dear visitor, the comments section is undergoing an overhaul and will return soon.