Oil

Oil prices have fallen in recent days, as the economic gloom adds to worries that world energy demand will shrink this year. In the New York market, US crude fell $1.88 to settle at $35.40 a barrel, while the London Brent fell to $44.53 a barrel.

The US Department of Energy said that stockpiles of crude increased by 6.7 million barrels last week, far higher than predictions from analysts for a gain totalling only 700,000 barrels. News of the buildup in recession-struck United States, the world’s biggest crude consuming nation, pushed New York crude down by $5.95 and London Brent oil by $4.67. Market participants also remain concerned over higher US jobless numbers and President-elect Barack Obama’s mammoth task of stimulating growth.

The recession-ravaged economy lost 2.6 million jobs over the course of 2008, the most since 1945, the Labour Department said. Of those, 1.9 million were lost in the past four months.

Oil prices rallied at the start of the week, bouncing back above $50 in London as the energy market was shaken by disruptions to gas supplies across Europe, already troubled by a cold snap. Russia has cut supplies bound for Europe via Ukraine in retaliation for Ukraine’s alleged theft of Russian gas. Ukraine denies siphoning off Russian gas and has accused Moscow of engineering the crisis.

World oil prices fell by about 54 per cent in 2008 as a sharp global economic slowdown weighed on energy demand in the second half of the year. However, in the first half, crude futures rocketed to record highs of above $147 a barrel in July on fears of supply disruptions. Towards the end of 2008, prices slumped to just above $33 — the lowest in four and a half years.

Saudi Arabia plans to go beyond Opec’s deepest ever single cut in supply as the world’s top oil exporter looks to halt a slide that has lopped over $110 off the oil price since July. The kingdom will pump below its Opec target in February and is prepared to go further still to bring a market battered by falling demand and a global recession back to balance.

The Saudi supply target was 8.05 million barrels per day (bpd), a little under 10 per cent of global output, after the Organisation of the Petroleum Exporting Countries (Opec) agreed to its biggest ever cut in December.

As the oil price has collapsed, the kingdom has shouldered most of Opec’s production cuts as it races to bring supply in line with demand. Opec, which pumps around a third of the world’s oil, is scheduled to meet again in March.

World oil demand will drop by 810,000 barrels per day in 2009 compared with last year, down 200,000 bpd from its estimate in December, the EIA said in its monthly outlook. “World oil consumption continues to be revised downward in response to the global economic downturn,” the EIA said in its monthly short-term energy outlook.

The statistical wing of the Department of Energy first predicted last month that world oil consumption would contract for the first time since 1983 as the world economy slows to a near standstill.

The EIA said it expected demand in the United States, the world’s top consumer, to fall by 390,000 bpd in 2009, compared with 2008. However, in its first predictions for 2010, the EIA said global demand could rise by 880,000 bpd to 85.98 million bpd, along with a modest rebound in the economy. U.S. oil demand should rise by 160,000 bpd to 19.28 million bpd in 2010, the EIA said.

Despite the economic downturn, the EIA said demand in emerging economies would rise, with demand from No.2 consumer China seen up by 280,000 bpd this year. Surging demand from emerging economies sent oil prices on a six-year rally.

Shrinking energy demand spurred by the financial crisis has taken its toll on world oil prices overall, however, with prices down from July’s record over $147 a barrel to $38 a barrel on January 13.

The drop in prices has hit the coffers of oil producing countries as well as energy companies, prompting Opec to agree to its steepest output reduction in history in December. Prices have yet to rebound, however, and some members have said the group could cut production again in March.

The EIA forecast Opec production will fall by more than two million bpd in first quarter of 2009 and average 30 million bpd for the year, before rising to 30.7 million bpd in 2010.

Saudi Arabia said recently that it had unilaterally cut production by more than its agreed Opec limit. It supplies about 40 per cent of the world’s oil. This decision is expected to bring the world’s largest oil producers output to 7.7 million barrels per day, 300,000 barrels below its pledge under Opec’s December agreement.

Gold

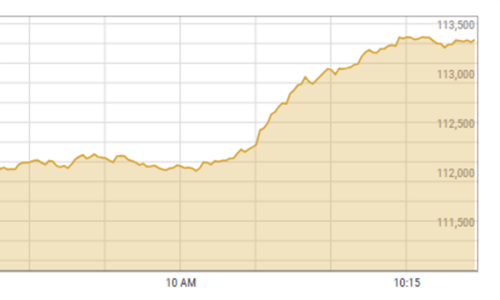

In the New York market gold traded slightly higher on January 15, holding just above the $800 an ounce level, as a stronger dollar against the euro and falling oil prices offset safe haven buying due to renewed credit fears. Gold for February delivery rose to $809.50 an ounce.

On January 15, in the London market, spot gold rose to a session high of $820.60 an ounce immediately after interest rate cuts, before slipping to a low of $807.

Gold, often seen as a secure store of value in times of turmoil, is benefiting from the fear triggered by a spate of poor economic data and bad news from banks that has raised the prospect of a prolonged recession.

The ECB cut rates for the fourth month in a row by 50 basis points. The decision initially pressured the euro but the single currency quickly bounced back as traders expect the cut to leave the door open for further cuts.

However, lower oil prices are putting some pressure on gold. Bullion typically moves in line with crude, as it is often bought as an inflation hedge, and the direction of the oil market is an indicator of interest in commodities.

Investor interest in gold remains strong. Bullion holdings of the SPDR Gold Trust in New York, the world’s largest gold-backed exchange-traded fund, rose to a record for the second time this year.

On the supply side, South African gold output fell 8.7 per cent in volume terms in November 2008 from a year before. The country’s gold output has fallen since the electricity grid suffered a near collapse last January.

Metals consultancy GFMS said in the second update of its 2008 Gold Survey that gold could revisit its record high above $1,000 an ounce by the end of June as government fiscal stimulus efforts undermine the greenback.

GFMS said it sees gold averaging $915 an ounce in the first half of 2009, up from an average $871.96 last year.

Dear visitor, the comments section is undergoing an overhaul and will return soon.