BRUSSELS: Star economists and former national leaders now happily argue that resolving the eurozone debt crisis will eventually demand a transfer of sovereignty to create a fully-fledged United States of Europe.

However, as they press for the political integration they say is needed to prevent the currency union collapsing on an Achilles heel of Greek debt, even advocates in unguarded moments admit resistance to the surrender of national sovereignty is rising.

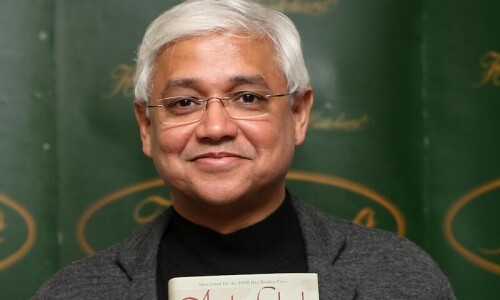

Either Europe moves forward to “political union,” celebrity economist Nouriel Roubini said in Brussels on Monday, or the result will be “eventual disintegration, break-up.”

Roubini was speaking at the launch of a manifesto by the self-appointed “Council for the Future of Europe,” a think tank set up by Nicolas Berggruen, the billionaire son of a famed German-Jewish art collector.

Famed for having accurately predicted the four-year-old financial crisis, Roubini was flanked by former German chancellor Gerhard Schroeder, ex-Spanish prime minister Felipe Gonzalez and other luminaries.

Offering their prescription for resolving what promises to be one of the toughest and riskiest seasons in European politics since integration began amid the rubble of World War II, the group also includes ex-British premier Tony Blair and Nobel laureate Joseph Stiglitz.

Collectively, they said today's masters of Europe need to swallow national pride and accept new, mutualised “eurobond” government borrowings, sovereign debt write-downs and a federal future.

A deal last month between German Chancellor Angela Merkel and French President Nicolas Sarkozy to beef-up cross-border eurozone governance has already “overcome a taboo,” insisted Schroeder.

Even outgoing European Central Bank chief Jean-Claude Trichet separately imagined on Monday the eurozone acquiring a “confederal government with a confederal finance minister,” one who could “impose decisions.”

Trying to avoid a repeat of the Greek mess — debts there now measure more than a year-and-a-half of the value of the country's economic output — is the biggest game in town here, but the obstacles remain huge.

On Wednesday, Germany's top court is to rule on the constitutional legality of the first Greek bailout in May 2010: at best for Merkel, it is expected to order much greater national parliamentary scrutiny of future fiscal transfers.

The next day, Finland should spell out its conditions for backing the second Greek bailout — agreed in July but still to be ratified, amid a row over demands by Helsinki and others for Athens to lodge cash collateral deposits with creditors.

Even at the top table, Finland managed to unpick the recommendations by Berggruen's panel when former prime minister Matti Vanhanen broke from the group's agreed statement and admitted: “I'm not so fond of federalism as such.”

The panel had said EU states “will need to share [transfer] certain dimensions of sovereignty to a central European entity that would have the capacity to source revenue at the federal level.”

Ultimately, they added, “it will be necessary to further lay out a vision of a federation that goes beyond a fiscal and economic mandate to include a common security, energy, climate, immigration and foreign policy.”

In other words, a United States of Europe — instead of what Gonzalez said was EU leaders “acting as firemen — not acting to prevent those fires” when the bloc was “facing global change, with no way back.”

The top demand among most observers, after August panic on markets saw stocks hammered and Italian, Spanish and French government borrowing costs shoot up, is for the creation of shared eurobonds.

But that idea has already been ruled out for the foreseeable future by Merkel and Sarkozy.

Just as worryingly for Berggruen was a column penned in the Financial Times, in which Germany's finance minister Wolfgang Schaeuble laid bare “my unease when some politicians and economists call on the eurozone to take a sudden leap into fiscal union and joint liability.”

He said eurobonds would remove pressure on governments to undertake needed reforms, and that the answer to the crisis, despite it being politically painful, is for states to live within their means.

Dear visitor, the comments section is undergoing an overhaul and will return soon.