Mortality of firms

IT is puzzling that most research in labour economics is focused on the developed economies while most workers are employed in the informal labour markets in developing countries.

The objective of this paper is to help bridge this gap by exploring wage-setting behaviour in the informal labour market in Pakistan and to compare it with wage setting in the formal sector.

Pakistan is ideally suited to the study of the informal labour market. It is the largest source of overall employment. The informal economy comprises small firms that are allowed to stay unregistered while the government operates within the law in contrast to the underground, illegal economy.

The informal sector here is defined as firms that employ less than 10 paid employees. We have taken the informal sector as consisting of enterprises operated by single individuals or households that are not separate legal entities from their owners and employ less than 10 paid workers. These include ‘family units’ (those operated by non-professional with or without contributing family workers) and/or ‘micro-enterprises’ (productive units with no more than nine employees).

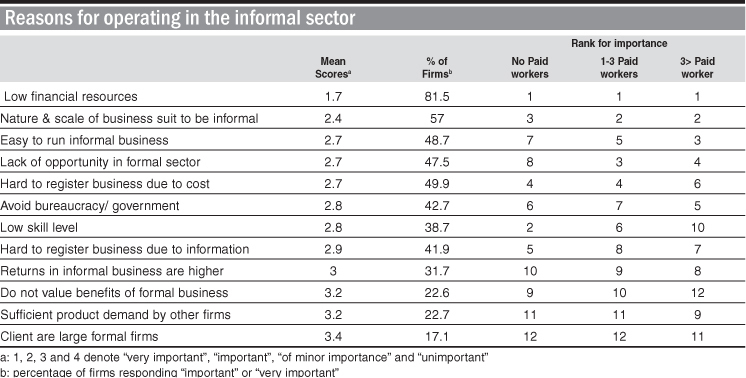

Scarce financial resources are the number one reason for businesses to be stuck in the informal sector

Limited access to capital markets, credit constraints, higher failure rates, lower wages, more frequent wage setting and the irrelevance of the minimum wage set the informal apart from formal sector.

The owners of informal sector firms were asked to rank their reasons for being in that sector.

Scarce financial resources are the number one reason for businesses to be stuck in the informal sector. The nature of their businesses and the ease of running them come second and third as reasons for operating in the informal sector, respectively.

An interesting picture emerges in ranking the top three mean scores by employment size (i.e. no regular paid worker, (three regular workers and more than three paid workers): While scarce financial resources remain the most important factor for all the three categories, the ease of running a business is among top three reasons for staying in the informal sector only for relatively bigger firms (i.e. three or more regular workers).

In other words, larger informal firms simply find it cumbersome to join the formal sector. As more efficient firms survive and become larger, their needs for enforceable contracts, formal credit markets, and access to public risk-pooling mechanisms increase, and so does their degree of formality or depth of participation in societal institutions.

The reason for firms belonging to the informal sector can mainly be found in their lack of working capital and limited access to financial markets.This makes their future more uncertain since informal-sector firms face a much higher probability of failure than formal sector firms.

Belonging to the informal market makes it possible for firms to reduce costs and have more flexibility in wage setting in addition to hiring and firing, which can be explained by the absence of buffers in the form of working capital or access to bank loans.

Informal sector firms live by the day and are more insecure, can easily wind up shop and are less keen to invest in physical capital — given their lack of access to finance — and the hiring and training of new workers — given their low average wages.

This means implies that entrepreneurs have a shorter time horizon which implies that they have a higher discount rate. The informal sector firms employ many workers who cannot enter the formal labour market because of a lack of skills, qualifications or networking within the formal sector, as manifested by the large wage gap between formal- and informal-sector white-collar workers.

Extracts from a staff note by State Bank officials — M. Ali Choudhary, Saima Naeem and Gylfi Zoega

Published in Dawn, Business & Finance weekly, May 16th, 2016