KARACHI, May 6: Two of the announcements made at the Karachi Stock Exchange on Monday, pertained to inter-corporate investment by Sapphire group of companies into an associated company.

Sapphire Textile Mills Limited and Sapphire Fibres Limited —the two stock market listed sister concerns — made separate announcements proposing to invest respectively Rs150 and Rs100 million in equity of the unlisted associated company, Sapphire Finishing Mills Limited (SFML).

Extraordinary general meetings of shareholders in Sapphire Textile and Sapphire Fibres have been called on May 30 to approve the transaction. Long-term investment already made by Sapphire Textile in SFML stands at Rs150 million and that by Sapphire Fibres Rs150 million.

Those equity investments were made after the shareholders gave their approval in the extraordinary general meetings held on August 26, 2000. The investments now proposed to be made, would enhance equity investment up to the maximum limit of Rs250 million by Sapphire Fibres and to Rs300 million by Sapphire Textile, in the associated company.

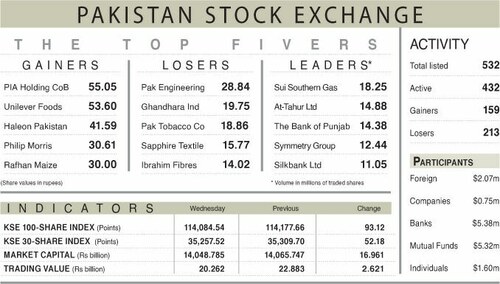

Both Sapphire Textile and Sapphire Fibres are blue chip companies, now trading at the stock market at Rs46 and Rs53.25, respectively for their 10-rupee share. Paid-up capital of the textile company is Rs200.8 million and that of Fibre’s Rs175 million. Both had paid cash dividends at 15 per cent each for financial year 2002. Inter-corporate investment is generally looked upon by investors with disdain. But given the group’s reputation, investors have to believe that the decision of the Sapphire board to place funds in associated unlisted undertaking must have been based on sound financial judgment.

Issuing an statement on Monday, under section 208 of the Companies Ordinance, 1984, the investor companies noted that the “amount of investment will be made from time to time as per equity requirement of SFML till the commencement of commercial production, which was delayed due to technical problems.” The commercial production was now expected to begin from July 2003.

Sapphire Finishing Mills Limited was said to be a fabric dying and finishing project with plant based on latest technologies. The Project was stated to be under implementation and was envisaged to be completed by end of June 2003.

The total project cost of Rs914.6 million had been financed equally through debt and equity investment. SFML was stated to have processing capacity of 108,000 meters of fabric per day. Authorized capital of the company stood at Rs500 million.

All seven directors of SFML were also directors in Sapphire Fibres and Sapphire Textile. Noting the purpose of investment, investor companies stated that it was a strategic investment for value added Textile Products, which was in line with government’s policy to encourage Textile Groups for development and production of value-added items for export purposes. “It will create export opportunities for products of STML and foreign exchange earnings for the country,” the companies said.

On the basis of in-house feasibility report, profit of SFML for the first three years had been worked out as: 1st year: Rs62.4 million; 2nd year Rs15.5 million and 3rd year: Rs33.1 million. “The investments would also yield dividend income from profits of SFML and as such shareholders will benefit from this investment,” the investor companies claimed.

As for benefits to the investor companies, Sapphire Textile stated that it produces woven cloth, which would be sold to SFML for export purposes and that Sapphire Textile could get dying and finishing of its woven fabric done from Sapphire Finishing which would result in increased sales, due to export of value-added fabric and finished products. Sapphire Fibres counted its benefits of investment that since it produces yarn and knitted cloth, yarn would be sold to weaving units and after process at SFML it could be exported. Also Sapphire Fibres could get finishing of its knitted fabric done from Sapphire Finishing, the company said.