KARACHI: Panic swept the trade floor on the stock market as news of Indian military jets crossing into Pakistan flashed on the news screens. As a result, the KSE-100 index dipped by 785.12 points to close at 38,821.67.

The Inter-Services Public Relations confirmed early morning that Indian military jets had violated Pakistan’s airspace in the dead of the night. Although the Indian claims of having inflicted damage were strongly refuted, it could scarcely calm investors’ nerves at the bourse who ran to seek the safety of the money market, triggering panic selling in stocks.

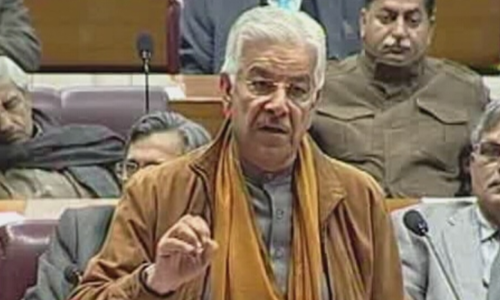

'Pakistan will respond': Politicians react to India's LoC breach

The market opened weak with the index showing a loss of 184 points in the first half hour. As panic gripped the market, retail individuals started to jettison shares at whatever the available price which sent the index reeling down by intraday low by 880 points.

Market watchers calculated that it was the largest decrease in the last 55 trading days and was the first time in 32 sessions that the Index had dropped below 39,000 points.

Figures released by the National Clearing Company of Pakistan in the evening helped calm some of the investors’ fears as they showed foreigners had bought net shares of $1.56m. Banks, companies and mutual funds had also stood on the sidelines, fighting the urge to give way to risk over greed.

“Valuations are undoubtedly attractive and long-term investors are marking time, before the market sheds the gloom,” affirmed well-known value investor Amin Tai. But most brokers and analysts wore a forlorn look, thinking that things may get worse before finally getting better.

Although mutual funds had kept their sangfroid with minor sale of $0.06m worth stocks, a fund manager admitted that in the event of massive selling for some more days, mutual funds could also be prompted to liquidate their positions to meet call for redemptions.

Individuals who were the major spoilers with net sale of huge $7.59m were thought to be mainly weak holders. “They ought mostly to be small investors entering into leveraged trading and forced to sell due to margin calls,” said a participant. Zulqarnain Khan, executive director of Next Capital Ltd, stated that the Monday night incident had only added to the weak sentiments. He pointed out that most corporates were churning out weak quarterly results due to losses on foreign exchange and the economy of the country was in a precarious state.

Until late afternoon, investors were seen arguing on what lay ahead. Several brokers, who asked not to be named, held on to selling optimism, pointing out that renewed selling at the market had erupted on Tuesday towards the close after the foreign minister said that Pakistan would respond to India’s act of aggression at time and place of its choosing. “That has put the market and investors in a state of uncertainty and fear, which might take some time to recede,” said one.

Other than the political tensions, significant fall in international oil prices saw exploration and production companies as the worst performers, chipping away 156 points. The index heavyweights, Habib and United Bank were again the major laggards.

Major decliners were Pakistan Petroleum, down 2.8pc, Oil and Gas Development Company 2.6pc, Habib Bank 0.8pc, Engro Corporation 1.6pc, MCB 1.6pc, Hub Power 0.1pc, Fauji Fertiliser 1.4pc, United Bank 1.9pc, Pakistan Oilfields 2.1pc and Lucky Cement 3.2pc, scrapping 314 points. On the flip side, Pakistan Tobacco went up 5pc to add 30 points.

The volume increased 137pc to 162m shares, from 68m while average traded value surged by 89pc to $50m, as against $26m. Most active stocks were Bank of Punjab, K-Electric, Engro Polymer and Chemicals, Pakistan International Bulk Terminal and Maple Leaf Cement, which contributed a third to the aggregate volume.

Published in Dawn, February 27th, 2019