KARACHI: The stock market was rattled on Monday with the KSE-100 index tumbling by 601 points, or 1.26 per cent. The index could just manage to cling to the 47,000 level by fewer than four points and closed at 47,002.

Several negative developments in the outgoing week sparked concerns among investors, most of whom thought it prudent to dump the shares first and ask questions later. Intraday the index tanked 701 points, but managed to show some recovery mid-day.

Although the downgrade by the MSCI to Frontier Market (FM) after languishing in Emerging Market (EM) for four years, came as a major surprise to investors, much of the market had anticipated the FATF’s adverse decision before it arrived on Friday. “The FATF’s decision to retain Pakistan in the grey list was mostly priced in the share values during trading in the days leading to the announcement,” a major market participant conceded.

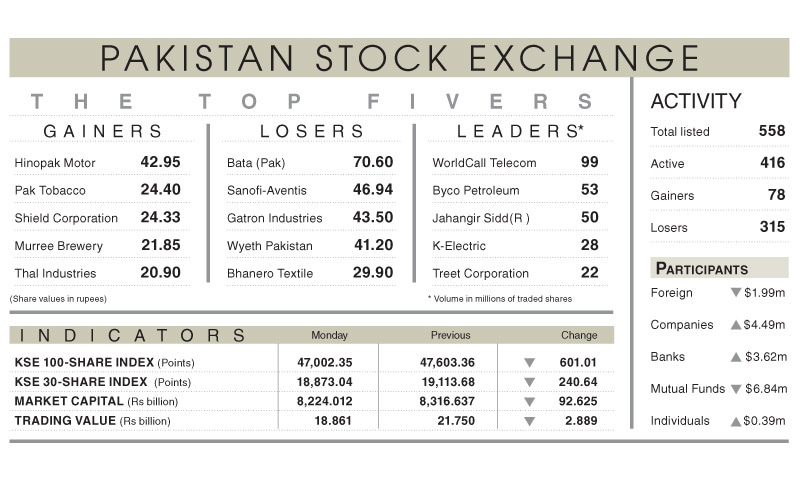

He thought that the investors were spooked also by the huge rollover settlements amounting to over Rs15bn. Besides, only three days to the end of the financial year, many companies and banks resorted to “window dressing”. Companies picked up shares worth $4.49m at dips and banks also mopped up liquidity amounting to $3.62m. Mutual funds were the major sellers of equity worth $6.84m which was thought to be due to profit-booking as well as redemptions.

The differences aired by government and the opposition over matters that could delay the passage of Finance Bill 2021 by the Senate also kept investors on their toes. Other than that investors and industrialists worried over the energy crisis and shortage of LNG.

Selling pressure was witnessed across the board with the heaviest drops recorded in banks (191 points), cement (106 points), O&GMCs (53 points), E&P (52 points) and textiles (45 points). Scrips that dragged down the index most included HBL (69.38 points), Lucky Cement (51.14 points), UBL (42.52 points), Hubco (33.2 points), and MCB (24.01 points).

The trading volume declined 14pc to 655.1m shares from 761.4mn shares.

Published in Dawn, June 29th, 2021