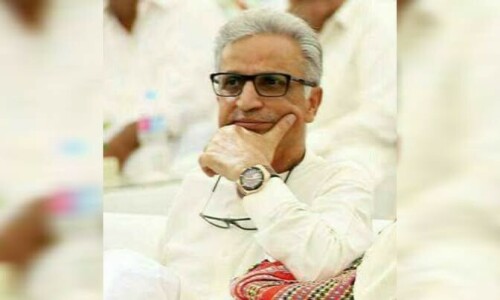

ISLAMABAD: President Dr Arif Alvi on Tuesday upheld a decision of the Banking Mohtasib of Pakistan directing the Bank of Punjab (BoP) to refund Rs423,556 to the family of a deceased borrower which the bank had “unilaterally and unfairly” recovered from his family.

The president observed that the bank had unnecessarily complicated a routine matter as its own standard operating procedures empowered it to give relief in such cases.

Mian Allah Wasaya had availed a loan of Rs3 million in 2015 from the Bank of Punjab and deposited Regular Income Certificates (RICs) issued by the Central Directorate of National Savings, valuing Rs3.5m, as liquid security with the bank.

On January 27, 2017, Allah Wasaya passed away, and the bank on its own encashed the RICs then worth Rs4.155m and charged a mark-up of Rs480,489 till October 22, 2018, while the accumulated mark-up at the time of his death was only Rs57,294.

Bank accused of recovering mark-up beyond Rs57,294 without justification

The widow of Allah Wasaya (the complainant) requested the bank to charge mark-up till the period her husband was alive and waive the mark-up thereafter.

The bank, however, did not accede to her request after which she approached the banking ombudsman.

After hearing the case and perusing the available record, the banking ombudsman noted that at the time of Allah Wasaya’s death the principal outstanding amount was Rs2.889 million and the accumulated mark-up was Rs57,294 only.

In the given circumstances, it was the fiduciary responsibility of the bank to guide the legal heirs for adjustment of outstanding liability at this level against encashment of RICs, the ombudsman observed.

The ombudsman noted that instead of exercising its statutory obligation to set off the loan against liquid security, the bank continued to linger on recovery and unnecessarily piled up mark-up on the principal outstanding amount which was unfair as per the State Bank of Pakistan’s guidelines.

The ombudsman said the bank’s claim that the matter pertained to the year 2018 and its books had been closed and, therefore, it was not in a position to provide financial relief was ‘absurd’ and ‘unprofessional’.

The ombudsman added that no rule, regulation, law or accountant standard had been referred which barred the bank from revisiting the old/closed cases and as such types of transactions were a routine matter.

The banking ombudsman held that unilaterally charging and recovering mark-up without justification beyond Rs57,294 was an injustice to the deceased borrower’s family.

The ombudsman observed that the bank had committed maladministration and malpractice by not exercising its rights without any valid reason, even though it held fully cashable liquid security under the loan agreement documents and piled up mark-up liability unnecessarily.

The bank, subsequently, filed a representation against the ombudsman’s decision with the president.

President Alvi upheld the ombudsman’s decision and held that the bank had not provided any justification to upset the original order of the ombudsman.

“The representation is rejected as it is devoid of any merit and the bank had failed to discharge the burden and statutory liability cast upon it under the law,” the president noted in his decision.

Published in Dawn, March 2nd, 2022