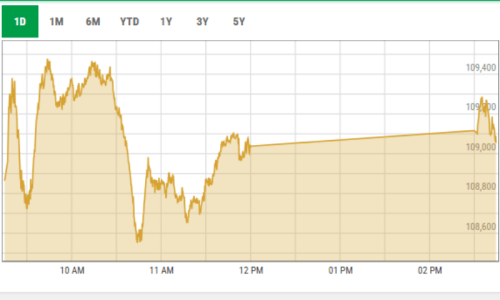

The Pakistan Stock Exchange (PSX) maintained a bullish momentum for a ninth consecutive session on Monday as shares gained 916.43 points to make the market near 110,000.

The benchmark KSE-100 index closed at 916.43 points up, or 0.84 per cent, to stand at 109,970.38 points from the previous close of 109,053.95.

In the past two weeks, the PSX has witnessed as many record single-day gains. Extensive mutual fund buying during the outgoing week sent the index soaring by a record point-wise weekly gain of 7,697 points.

Yousuf M. Farooq, research director at Chase Securities, noted: “Interest rates, which were at an all-time high, have now returned to more normal levels. This shift has rapidly brought stock valuations to more reasonable levels.”

He added that market interest rates, which stood at over 20.5pc in June 2024, are now close to 12pc. Expectations of an interest rate cut in the upcoming Monetary Policy Committee meeting on December 16 have also risen.

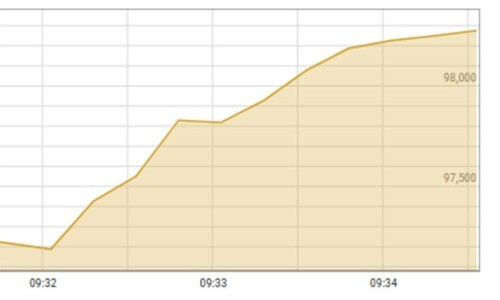

“This significant decline has driven a substantial shift from fixed income to equities, with mutual funds — now much larger than in the last cycle — injecting record sums into the equity market at an unprecedented pace,” Farooq said.

According to the analyst, the current market dynamics can be described as a reversion to the mean.

Farooq said he believed the rally would result in long-term market returns normalising, with investors likely to achieve returns close to historical long-term averages going forward.

However, he added, banks opened “under pressure today due to media reports suggesting that the government is exploring additional ways to tax banks, which are already contributing a significant portion of their income as taxes”.

Awais Ashraf, director of research at AKD Securities, said that investor interest in equities was driven by expectations of monetary easing in the upcoming Monetary Policy Committee meeting amid improving macroeconomic situation.

He also noted, “However, concerns persist regarding the banking sector — the heaviest-weighted sector in the KSE-100 — after the prime minister established a committee to review the status of the ADR [advance to deposit ratio] tax and explore alternative fiscal measures for taxing banks on profits from government securities.”

Analysts have attributed the optimism among investors to improved macroeconomic indicators as well as inflation dropping to 4.9pc, its lowest level since 2017.

Additionally, Saudi Arabia extended a $3 billion deposit with Pakistan for another year to support its economy, providing further momentum to the index. Furthermore, Pakistan has converted seven out of the 37 MoUs signed with Saudi Arabia into formal contracts worth $560 million.