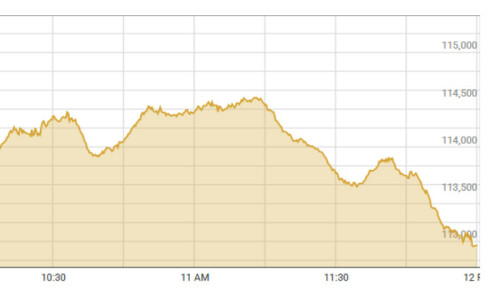

Bears continued their stampede on the trade floor as shares at the Pakistan Stock Exchange (PSX) slid nearly 4,800 points on Thursday.

The benchmark KSE-100 index declined by 4,355.76 points, or 3.92 per cent, to stand at 106,714.53 from the previous close of 111,070.29 at 3:02pm.

Finally, the index closed at 106,274.97, down by 4,795.32 or 4.32pc from the previous close.

Today’s decline, a day after the KSE-100 index lost nearly 3,800 points, marks the largest single-day point-wise loss.

Awais Ashraf, director research at AKD Securities, attributed the momentum to “the National Assembly bill aimed at targeting non-filers and restricting their ability to invest in mutual funds or maintain bank accounts is creating concern among investors”.

“We believe that broad-based compliance will ultimately benefit the equity market in the long run and is unlikely to have a significant impact on investment flows in the medium term,” he commented.

Moreover, he also attributed the decline to “stock-specific selling due to overvaluation concerns”.

He advised investors to “remain invested in equities, as declining fixed income rates are expected to drive further inflows into the equity market”.

Yousuf M. Farooq, director research at Chase Securities, said, “The market has entered a corrective phase following a significant rally over the past year.

“We believe that earnings will now drive market performance rather than valuation rerating. The correction has been exacerbated by multiple research reports downgrading Mari Petroleum to a sell,” he stated, adding that despite this, the overall valuations in the market remained attractive and below their long-term averages.

Farooq said that he remained optimistic about the economy and the stock market, adding that the full impact of recent interest rate cuts had yet to materialise and would require time.

“Looking ahead, we anticipate a slower pace of rate cuts, with reductions of 50bps to 100bps expected over the next year, as opposed to the larger cuts seen previously,” he highlighted.

“We advise long-term investors to stay patient — market corrections offer excellent opportunities for value investing,” he recommended, adding that retail investors “should focus on the bigger picture”.

The index lost over 5,000 points or 4.4pc in the previous two sessions post-rate cut, which could be classified as nervous selling if it was called panic-offloading despite positive economic indicators.]

On Monday, the State Bank of Pakistan (SBP) cautiously eased the interest rate to 13pc, which analysts had attributed to the cautionary monetary policy easing, coupled with guidance indicating a likely modest uptick in inflation in the coming months.

Tahir Abbas of Arif Habib Ltd (AHL) told Dawn that the correction was healthy since the market had consistently set records in recent weeks.

He explained that extensive selling by mutual funds due to rising redemption was the key factor that drove the market down in the last two sessions.

Dear visitor, the comments section is undergoing an overhaul and will return soon.