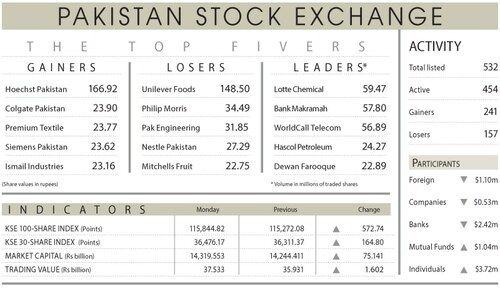

KARACHI: Despite strong anticipation of a sixth straight cut in the interest rate at the monetary policy review meeting later in the evening, the Pakistan Stock Exchange on Monday witnessed a roller-coaster session mainly due to political instability, a hike in gas tariffs and disappointing corporate results.

The Economic Coordination Committee’s decision to increase the gas tariff by almost 17pc for captive power plants was the key depressant. This move drew a strong reaction from the export-oriented players, especially the textile sector, saying this move would hurt the country’s export competitiveness in the regional and international markets.

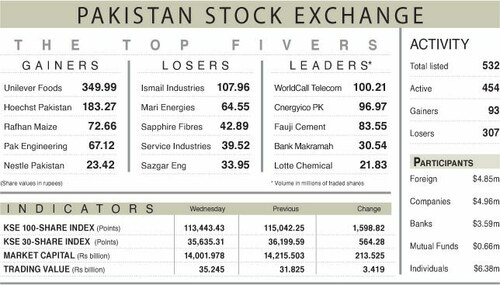

Topline Securities Ltd said the market opened positively, with the index making an impressive intraday high of 716 points. However, the momentum was short-lived as bears swiftly took charge. The index plunged to an intraday low of 1,398 points before closing at 113,520, marking a decline of 1,360 points or 1.18pc day-on-day.

“This negative trend can largely be attributed to Mari Energies’ weaker-than-expected financial results, which dampened investor sentiment. The company reported earnings per share (EPS) of Rs9.3, with no cash payout, falling below market expectations and contributing significantly to the bearish activity observed during the trading session,” the brokerage house observed.

Pakistan Oilfield declared its 2QFY25 result, where the company posted an EPS of Rs26.7, taking 1HFY25 earnings to Rs35.7 per share, down 42pc. However, it announced a cash dividend of Rs25 per share for 1HFY25.

Scrips contributing positively to the index include Systems Ltd, Engro Fertiliser, Fauji Fertiliser, Pakistan Oilfield, and Bank Al-Habib, which added 282 points. Conversely, substantial declines in Mari Energies, Engro Holdings, PSO, Hub Power, and Pakistan Petroleum Ltd weighed heavily on the market, accounting for a combined loss of 783 points.

Ahsan Mehanti of Arif Habib Corporation said stock turned bearish amid a rout in global equities and weak international crude oil prices.

He added that uncertainty over the outcome of government-PTI talks, an expected cautious SBP policy decision later in the day and worries over proposed Tax Laws Amendment Bill 2024 limiting non-filers from making stock purchases worried investors who resorted to panic selling.

As a result, the trading volume plunged 21.38pc to 494.03 million shares while the traded value dipped 31.37pc to Rs25.94bn day-on-day.

Published in Dawn, January 28th, 2025