KARACHI: The Pakistan Stock Exchange (PSX) extended its bullish spell to a fourth straight session on Tuesday, helping the benchmark KSE 100 index breach another barrier of 117,000 thanks to optimism related to the IMF’s positive review of the economy.

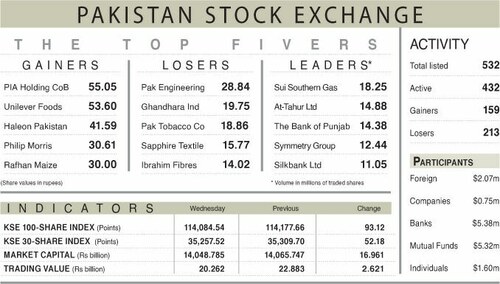

Topline Securities Ltd said the bulls dominated the session, propelling the benchmark index to an intraday high of 1,002 points before settling at 117,001, up 801 points or 0.69 per cent day-on-day.

The positive sentiment was primarily driven by encouraging economic developments. According to news reports, the IMF has permitted Pakistan to borrow Rs1.25tr ($4.5bn) from domestic banks to help manage the Rs2.4tr circular debt in the power sector without increasing public debt.

The investor confidence was further lifted as the IMF shared a draft of the Memorandum of Economic and Financial Policies (MEFP) with Pakistani authorities, marking progress toward a Staff-Level Agreement under the $7 billion Extended Fund Facility (EFF). This reinforced hopes for sustained financial support and economic stability.

Fauji Fertiliser Company, Engro Holdings, Hub Power, TRG, and Lucky Cement primarily fuelled the index’s gains, which collectively added 541 points.

Ahsan Mehanti of Arif Habib Corporation said the PSX stayed bullish as investors weighed the $12m current account deficit in February, dropping by 97pc month-on-month.

Ali Najib, Head of Sales at Insight Securities, said the IMF go-ahead to settle the circular debt fuelled a rally in the exploration and production (E&P) and Oil Marketing Company (OMC) sectors.

The market ignored a 45pc plunge in Foreign Direct Investment in February and a 1.22pc contraction in Large-Scale Manufacturing in January.

However, the market participation was subdued as the trading volume fell 11.44pc to 449.48 million shares while the traded value decreased 14.44pc to Rs29.17bn day-on-day.

Stocks contributing significantly to the traded volume included Pakistan International Bulk Terminal (59.13m shares), The Bank of Punjab (36.47m shares), Fauji Cement (24.98m shares), Pakistan Refinery (21.54m shares) and TRG Pakistan (18.34m shares).

Published in Dawn, March 19th, 2025